This story was originally published and last updated .

The world feels like it’s gotten smaller in recent decades thanks to technology, but we’re far, far away from adopting a universal currency. Sending money across borders — from the US to India, for example — is still not as seamless as we’d like it to be. Google Pay wants to change this.

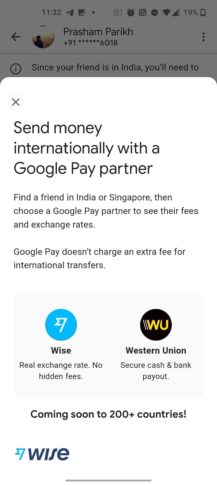

Google recently announced its partnership with Wise (previously known as TransferWise) and Western Union, which allows users in the US to send money to India and Singapore from within the application. Yes, one less application/website to deal with.

Before we jump into how it all works, it’s important to note that the recipient will have to be registered on Google Pay and have their bank account connected via UPI in India and PayNow in Singapore. Also, payments are currently only possible from person to person — businesses can’t send or receive money yet. If these things are taken care of, you can move on to the steps below…

1. If the recipient is already in your contacts list, you can enter their name in the search bar. If not, you can use either their number or email ID to initiate the payment.

2. Once you tap on the recipient’s name, you’ll open the payment window. You should see a disclaimer at the top saying you’ll need to use a Google Pay partner to send money internationally.

3. In the box at the bottom, enter the amount you want to send and tap on pay.

4. This will bring up a card asking you to choose between Wise and Western Union, the two partners Google Pay supports right now. The best part is you’ll be able to see the actual amount that will reach the recipient before you proceed.

5. If you go ahead with Western Union, the recipient has the option to pick up the cash in person or directly receive it in their bank account. You can choose to pay the amount via your debit/credit card, bank account, or Google Pay balance. There’s a $50,000 limit per transaction.

6. If you select Wise, you’ll only be able to pay via your credit or debit card. The amount you send will directly be deposited in the recipient’s bank account. There’s a $2,000 limit per transaction.

7. Once the payments are initiated, you’ll be able to track the status of it within the contact’s chat itself.

Western Union is offering unlimited free transfers until June 16 and if you’re a new Wise customer, you can send your first payment (under $500) for free. So, if you’re looking to send some money to someone in India or Singapore, now may be a good time to do so.

Google Pay is already working on expanding support to over 200 countries with Western Union and 80 with Wise before the end of this year.

Post a Comment